Just How Medicare Supplement Can Enhance Your Insurance Coverage Protection Today

As people browse the details of medical care plans and seek thorough security, comprehending the subtleties of extra insurance policy becomes progressively important. With an emphasis on bridging the gaps left by standard Medicare strategies, these additional choices provide a customized strategy to meeting details demands.

The Basics of Medicare Supplements

Medicare supplements, also called Medigap plans, provide added insurance coverage to fill up the spaces left by original Medicare. These supplemental plans are supplied by personal insurance business and are created to cover costs such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Component A and Part B. It's necessary to note that Medigap strategies can not be utilized as standalone plans yet work along with original Medicare.

One trick element of Medicare supplements is that they are standard across most states, providing the exact same fundamental benefits no matter the insurance coverage company. There are 10 different Medigap strategies classified A through N, each giving a various level of coverage. As an example, Plan F is one of one of the most detailed alternatives, covering nearly all out-of-pocket prices, while other strategies may use more minimal insurance coverage at a reduced costs.

Recognizing the essentials of Medicare supplements is important for people coming close to Medicare eligibility who want to boost their insurance coverage and minimize prospective monetary concerns connected with health care costs.

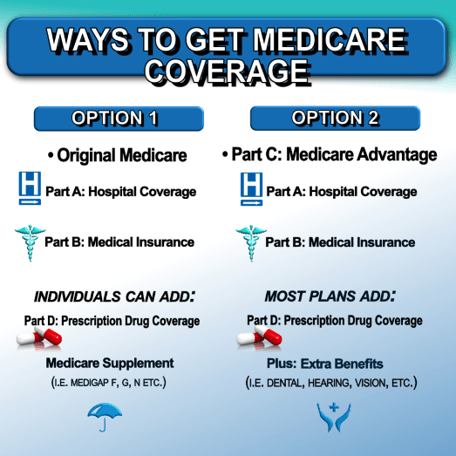

Recognizing Insurance Coverage Options

When considering Medicare Supplement intends, it is essential to comprehend the various coverage choices to ensure detailed insurance security. Medicare Supplement intends, additionally understood as Medigap policies, are standard across most states and identified with letters from A to N, each offering varying levels of protection - Medicare Supplement plans near me. Additionally, some strategies might supply insurance coverage for services not included in Original Medicare, such as emergency care throughout international travel.

Benefits of Supplemental Plans

Additionally, extra strategies offer a wider range of protection options, including access to healthcare suppliers that might not approve Medicare task. Another advantage of supplementary strategies is the capability to take a trip with peace of mind, as some check out this site strategies offer protection for emergency situation medical services while abroad. Generally, the benefits of additional strategies add to a more thorough and tailored technique to healthcare insurance coverage, guaranteeing that people can receive the care they require without dealing with overwhelming financial burdens.

Price Factors To Consider and Cost Savings

Given the financial security and more comprehensive insurance coverage choices provided by supplemental strategies, a vital element to consider is the price factors to consider and potential financial savings they use. While Medicare Supplement plans call for a regular monthly premium along with the common Medicare Part B costs, the benefits of lowered out-of-pocket expenses frequently surpass the added expenditure. When reviewing the expense of supplementary strategies, it is necessary to contrast costs, deductibles, copayments, and coinsurance across different strategy types to establish the most cost-efficient choice based upon individual medical care requirements.

In addition, choosing a strategy that aligns with one's health and wellness and budgetary demands can cause significant financial savings in time. By picking a Medicare Supplement plan that covers a greater percent of health care expenses, people can lessen unforeseen prices and budget plan a lot more efficiently for healthcare. Additionally, some additional strategies provide family discounts or rewards for healthy and balanced actions, offering additional possibilities for price savings. Medicare Supplement plans near me. Ultimately, investing in a Medicare Supplement strategy can supply valuable financial security and comfort for recipients looking for thorough insurance coverage.

Making the Right Option

Choosing the most suitable Medicare Supplement navigate to these guys plan demands mindful factor to consider of private health care requirements and financial circumstances. With a variety of strategies readily available, it is essential to analyze aspects such as protection choices, premiums, out-of-pocket prices, copyright networks, and total value. Understanding your current wellness condition and any anticipated clinical requirements can guide you in picking a look these up strategy that provides comprehensive insurance coverage for services you might need. Furthermore, evaluating your spending plan restrictions and comparing premium prices among various plans can aid make sure that you select a strategy that is economical in the long-term.

Final Thought

Comments on “Easy Accessibility to Medicare Conveniences: Medicare Supplement Plans Near Me”